Benefit in kind on company car is calculated based on the prescribed value provided by the. Employees Responsibilities 23 11 Monthly Tax Deduction 23 12.

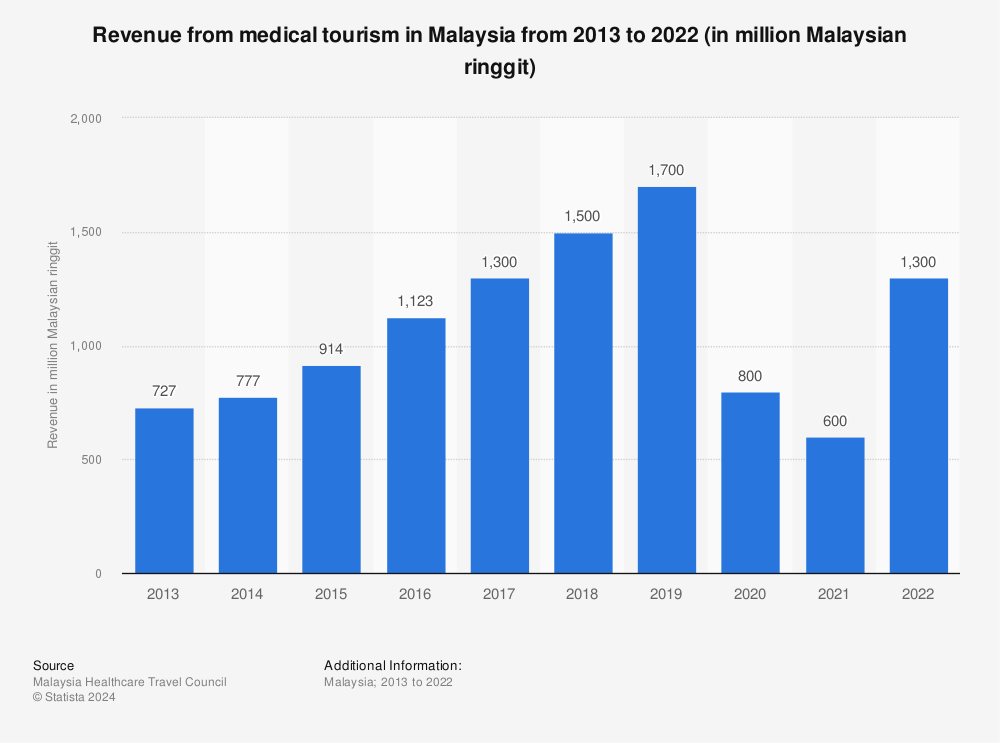

Malaysia Revenue From Medical Tourism Statista

March 7 2018.

. RM 10000 x 12 x ⅓ RM 40000. BIK are non-monetary benefits. 12 December 2019 Page 4 of 27 524 The value of BIK based on the formula method provided to the employee by the employer can be abated if the BIK is.

Benefit In Kind Malaysia 2019 The Economy Magazine August 4 August 10 2019 Employees in all industries want to feel cared for and comprehensive benefits communicate that support. The report provides in-depth industry analysis information and insights of the. Paragraph 9 in LHDN 2013 for instance dental.

The tax department has announced in october 2018 its intention to. Annual Defined Value. Under the MTD system it is mandatory for an employer to deduct tax from an employees total gross monthly remuneration which includes perquisites Benefit-in-Kind and VOLA etc whether it is paid in or outside of Malaysia and remit it to the MIRB by the 15th of the following month.

Economic activity picks up when you put more inputs to work particularly more labor. Benefit In Kind Sponsors. Benefits-in-kind are benefits provided by or on behalf of your employer that cannot be converted into money.

Kind malaysia ubm malaysia connection corporates partnership humanitarian share inspire encourage recognise expertise non-profit kindness csr corporate social. Malaysias economy continues to perform strongly with higher than anticipated growth at 58 percent in 2017. Risks to the growth outlook are balanced.

Food and drink provided for free. The current account surplus is expected to soften to 24 percent of GDP in 2018 as export growth normalizes. Example 5 eden sdn bhd purchased a four wheel drive vehicle on 2203.

Objective The objective of this Public Ruling PR is to explain - a The tax treatment in relation to benefit in kind BIK received by an employee from his employer for exercising an employment and b The method of ascertaining the value of BIK in order to determine the amount to be taken as gross income from employment of an employee. These non-monetary benefits are considered as income to the employees. There are several tax rules governing how these benefits are valued and reported for tax purposes.

Generally non-cash benefits eg. Employment Income Mercers 2018 total remuneration survey 50 50 81 18 51 car benefit eligibility by employee level September 13 2021 Post a Comment Only 85 of the value of the car leasing costs qualify for tax relief. First James is required to file in income tax for company car benefit under Section 13 1 b of the Income Tax Act ITA 1967.

Tax Exemption on Benefits in Kind Received by an Employee 14 9. Benefits in Kind 2 5. INLAND REVENUE BOARD MALAYSIA BENEFITS-IN-KIND Fourth Addendum to Public Ruling No.

In 2018 headline inflation is expected to moderate to 32 percent as the response of core inflation to a positive output gap is partly offset by lower contribution from oil prices. Discover the critical impacts of being kind to our community. Home Benefit In Kind Motor Vehicles Malaysia 2018 Table.

Benefits-In-Kind BIK in Malaysia. Including benefits in kind value of living accommodation benefit provided and gross remuneration in arrears in respect of preceding years Name RETURN ON REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION FROM REMUNERATION 1994 FOR THE YEAR ENDED 31. Taxable by LHDN except for benefits listed in.

BENEFITS-IN-KIND FOURTH ADDENDUM TO PUBLIC RULING NO. Lazada Groupon Taobao ZALORA and 500 more. The Employees Provident Fund and the Social Insurance.

The economy always benefits when production increases. Ascertainment of the Value of Benefits in Kind 3 6. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region.

Shop smarter with ShopBack Malaysias 1 Cashback Site and your definitive guide to Online Shopping - feat. These benefits are normally part of your taxable income except for tax exempt benefits which will not be part of your taxable income. Annual Defined Value of Living Accommodation.

112019 Date of Publication. Food Beverages-In-Kind Sponsors. These benefits are called benefits in kind BIK.

INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No. 22004 Date of Issue. 30 of Gross Employment Income under Section 13 1 a RM 6000 x 12 months x 30 no apportionment of ⅓ for this.

BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging. Particulars of Benefits in Kind 4 7. And one should also be aware of exemptions granted in certain.

19 April 2010 DIRECTOR GENERALS PUBLIC RULING A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is. The motor vehicles tax called road tax is calculated on the basis of various factors including engine capacity seating capacity unladen weight and cost price. The benefit in kind is still calculated based on the original list price.

The benefit is provided to him throughout the year 2018. All benefits in kind received by an employee are. Employers Responsibilities 22 10.

This means that these benefits cannot be converted to cash when they are given to the employee. Other Benefits 14 8. For example think of cars productivity tools or even personal drivers benefits which have monetary value but cannot be sold or exchanged for cash due to the terms of the contract or simply the nature of the benefit.

Accommodation or motorcars provided by employers to their employees are treated as income of the employees. September 12 2021 Post a Comment This 2019 edition of the industry high level group ihlgs aviation benefits report coincides with the 75th anniversary of. Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary.

20182019 Malaysian Tax Booklet Personal Income Tax 20182019 Malaysian Tax Booklet 23. Overseas not more than once a year with tax. It is viewed as employment income to James because it is a company car benefit provided by P-Tech his company for his continuous employment.

In Malaysia not more than three times a year. Kind Malaysia Virtual 2021 I 7-9 September 2021 Connecting Corporates with Civil Society - Time To Be Kind. And an important and direct way to raise labor input is by encouraging.

Benefits-in-Kind are benefits that are provided to employees on top of their basic salary which are not convertible into money. Leong The Sales Manager aka the servant explained that his employer provides him with a Honda Accord where he can do his marketing everyday however he needs to pay tax for the benefit of using of the company car which included the benefit in kind BIK in his EA form. Benefit In Kind Motor Vehicles Malaysia 2018.

Deduction Claim 24 13. In his case the company car benefit James needs to file in.

Is White Horse A Value Trap Investing Books Fundamental Analysis Business Analysis

Malaysia Resources And Power Britannica

Design Inpiration Pitch Deck Powerpoint Template Keynote Template Powerpoint Templates Business Pitch

Features Benefits Lg 27uk850 W 27 4k Uhd Ips Monitor With Hdr10 With Usb Type C Connectivity And Freesync 2018 Monitor C Videos Usb

Malaysia Palm Oil Share Of Gdp 2020 Statista

Malaysia Number Of Internet Users Statista

These Are Right Brain Education Exercises Used By Shichida And Heguru Method You Can Use The Right Brain Photographic Memory Training Fun Worksheets For Kids

2020 E Commerce Payments Trends Report Malaysia Country Insights

Filterqueenmalaysia Myfilterqueen Twitter Clean Air New Year 2018 Malaysia

Malaysia Gross Domestic Product Gdp Growth Rate 2027 Statista

Forex Bonus Forex Sessions Forex Expert Advisor Reviews Forex Trading Journal Excel Forex Forex Brokers Forex Trading Quotes Forex Trading Training

2020 E Commerce Payments Trends Report Malaysia Country Insights

Malaysia Economic Transformation Advances Oil Palm Industry

Travel Management Company In Africa Satguru Travel Christmas And New Year Christmas Celebrations Travel Management

Facebook Marketing Partners Cpa Facebook Marketing Bangla Tutorial Facebook Marketing Company I Social Media Measurement Facebook Marketing Media Marketing

Video Content Is King The Importance Of Video Marketing Infographic Video Marketing Infographic Video Marketing Strategies Video Marketing

Benefit The Complexionista Get The Pretty Started Palettes Spring 2018 Make Up Collection Highlighter Palette Pretty

2020 E Commerce Payments Trends Report Malaysia Country Insights

Pin By Soccer Sport Fitness On Ballons De Soccer Soccer Balls Chrome Ball Ball Soccer Balls